TWENTY-FIVE ENCRYPTION POINTS HAVE ARRIVED: HIGH FDV TOKEN CRASH, AI INTEGRATION INFRASTRUCTURE AND GLOBAL REGULATORY NORMALIZATION

This post is part of our special coverage Syria Protests 2011

Original language: Deep tide TechFlow

Summary:

- The institution became a marginal buyer of encrypted assets。

- The physical assets (RWAs) were upgraded from narrative concepts to asset classes。

- stable coins become both &ldquao; killer-grade applications &rdquao; and systemic weaknesses。

- The second layer of the network (L2) is integrated into &ldquao; winner-takes-all &rdquao; pattern。

- The forecast market evolved from a toy-based application to a financial infrastructure。

- Artificial Intelligence and Encryption (AI & Times; Crypto) has been transformed from a narrative to a physical infrastructure。

- Launching the platform (Launchpads) to industrialize and become an Internet capital market。

- HIGH-TOTAL DILUTION VALUATION (FDV), LOW-CURRENT TOKENS HAVE PROVED STRUCTURALLY UNINVESTMENTABLE。

- Information finance (InfoFi) went through a boom, boom and collapse。

- Consumer-grade encryption returns to public view, but is achieved through new digital banking (Neobanks) rather than Web3 applications。

- Global regulation has gradually been normalized。

In my view, 2025 was a turning point in the field of encryption: it moved from a speculative cycle to a structure of basic, institutional size。

WE HAVE WITNESSED THE REPOSITIONING OF CAPITAL FLOWS, THE RESTRUCTURING OF INFRASTRUCTURE AND THE MATURITY OR COLLAPSE OF EMERGING AREAS. THE HEADLINES AROUND THE INFLOW OF ETF FUNDS OR THE PRICE OF COINS ARE JUST SYMPTOMS. MY ANALYSIS REVEALS DEEP STRUCTURAL TRENDS THAT UNDERPIN THE NEW PARADIGM OF 2026。

I will analyse the 11 pillars of this transformation one by one, each supported by specific data and events in 2025。

1. Institutions become the driving force behind encrypted financial flows

I believe that 2025 witnessed the full control of institutions over the mobility of the encrypted market. After many years of watching, institutional capital has finally moved beyond diaspora to become the dominant force in the market。

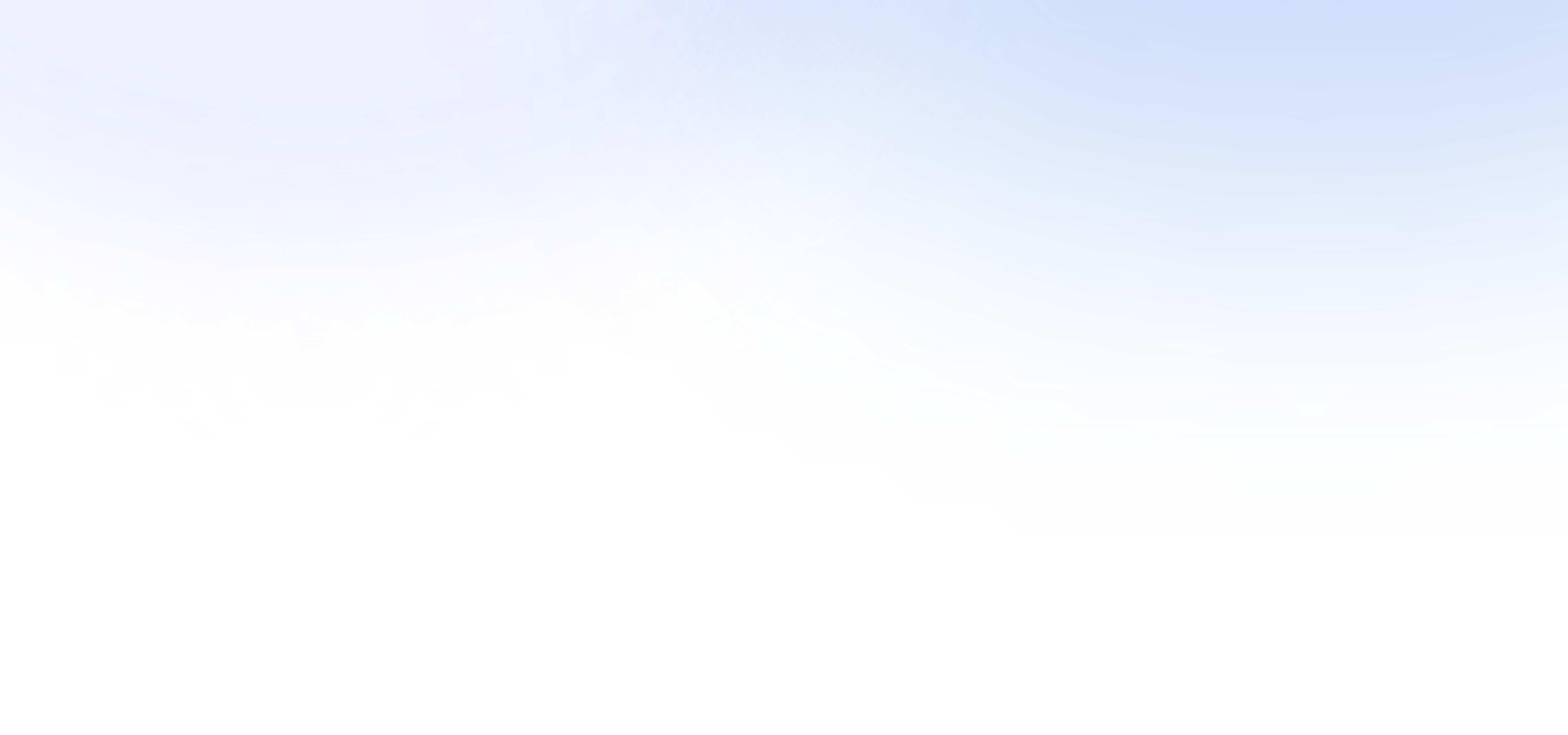

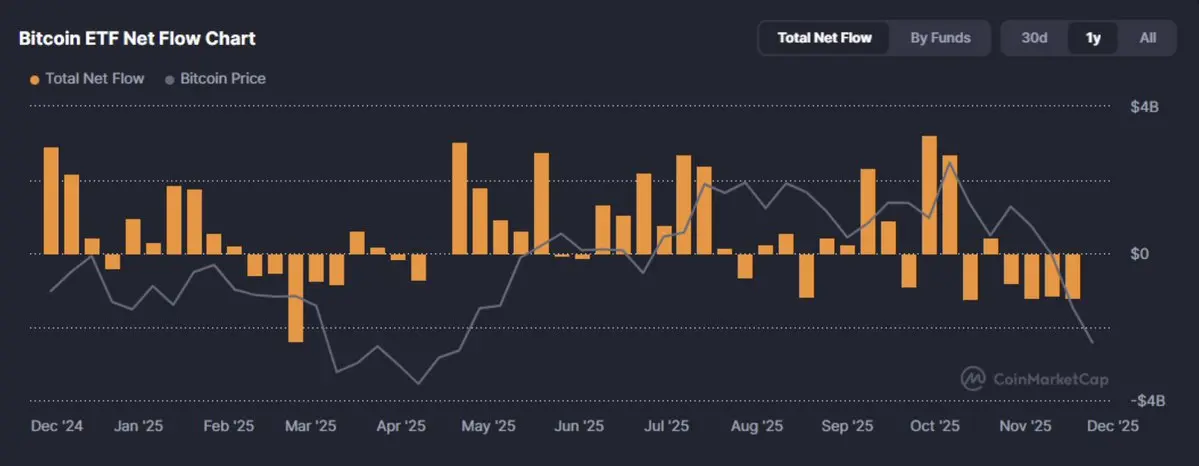

In 2025, institutional capital was more than just &ldquao; access to &rdquao; and the encrypted market, crossing an important threshold. For the first time, marginal buyers of encrypted assets have been transformed from bulkers to asset distributors. In the fourth quarter alone, United States spot bitcoin ETF flows more than $3.5 billion a week, leading by products like BlackRock's IBIT。

These flows are not random, but rather structurally authorized risk capital reallocations. Bitcoin is no longer seen as a curiously driven asset, but rather as a macro-tool with portfolio effects: digital gold, dramatic inflation hedges, or simply unrelated asset exposures。

However, this shift also has a double impact。

institutional flows are less responsive but more sensitive to interest rates. they reduce market volatility and bind encrypted markets to macroeconomic cycles. as one chief investment officer said: &ldquao; bitcoin is now a liquid sponge with a compliance shell. & rdquo; a globally recognized value stored asset with significantly reduced narrative risk; on the other hand, interest rate risk remains。

This shift in financial flows has far-reaching implications, ranging from the compression of transaction fees on exchanges to the reshaping of the demand curve for revenue-type stable currencies and physical asset monetization (RWAs)。

The next question is no longer whether institutions will enter, but rather how agreements, tokens and products will adapt to capital needs that are driven by the Sharpe Ratio ratio rather than the market。

2. Moving from concept to real asset class

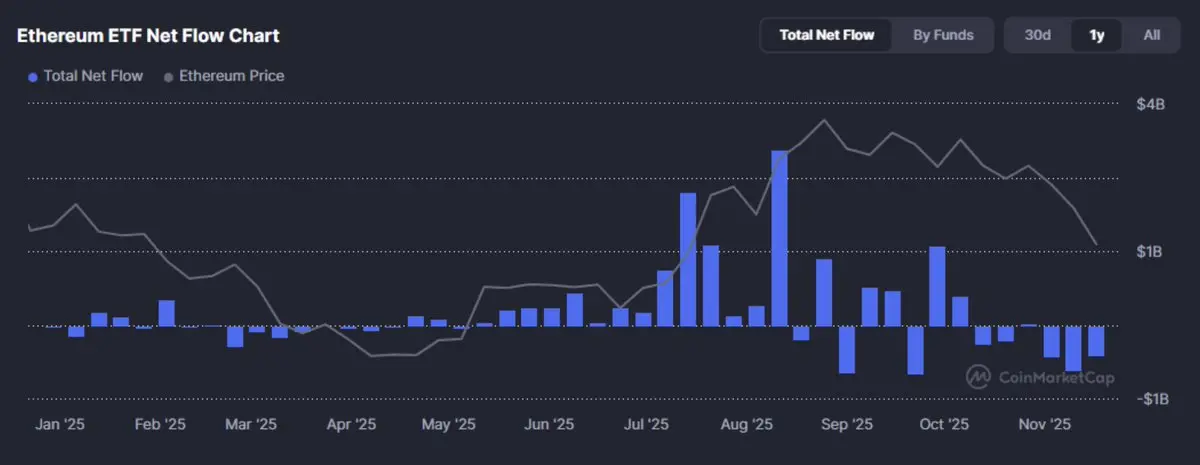

In 2025, tokenized physical assets (RWAs) moved from concept to capital market infrastructure。

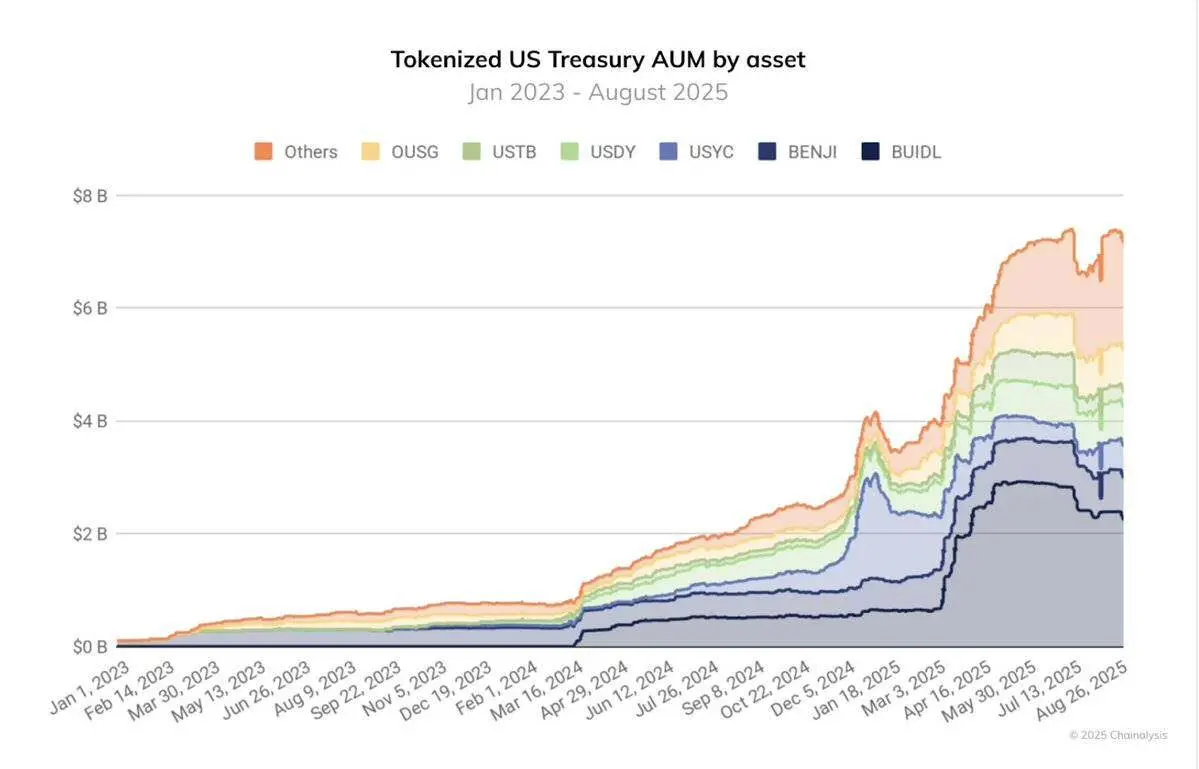

We have now witnessed substantial supply: As of October 2025, the total market value of RWA tokens had exceeded $23 billion, nearly four times the same rate. About half of them are monetized US Treasury and currency market strategies. With institutions such as BlackRock issuing BUIDL through $500 million in national debt, it is no longer a marketing boom, but a vault that is secured by chain-based insurance debt, rather than a code without collateral。

At the same time, stabilizers began to support reserves with short-term instruments, while agreements such as Sky (formerly Maker DAO) integrated chained commercial instruments into their mortgage asset pools。

The currency of stability, which was supported by the national debt, was no longer the existence of marginalization, but the foundation of an encrypted ecology. The size of the managed assets of the Fund (AUM) nearly tripled in 12 months, from approximately $2 billion in August 2024 to over $7 billion in August 2025. At the same time, the physical asset monetization (RWA) infrastructure of institutions such as JP Morgan and Goldman Sachs has officially shifted from a testing network to a production environment。

In other words, the line between chain liquidity and chain asset classes is gradually collapseing. Asset configurors in traditional finance no longer need to purchase currency related to physical assets, and they now hold assets directly in the form of original chain issuance. This shift from the presentation of synthetic assets to the monetization of real assets is one of the most influential structural advances in 2025。

3. stable currency: both “ killer-grade ” and systemic weaknesses

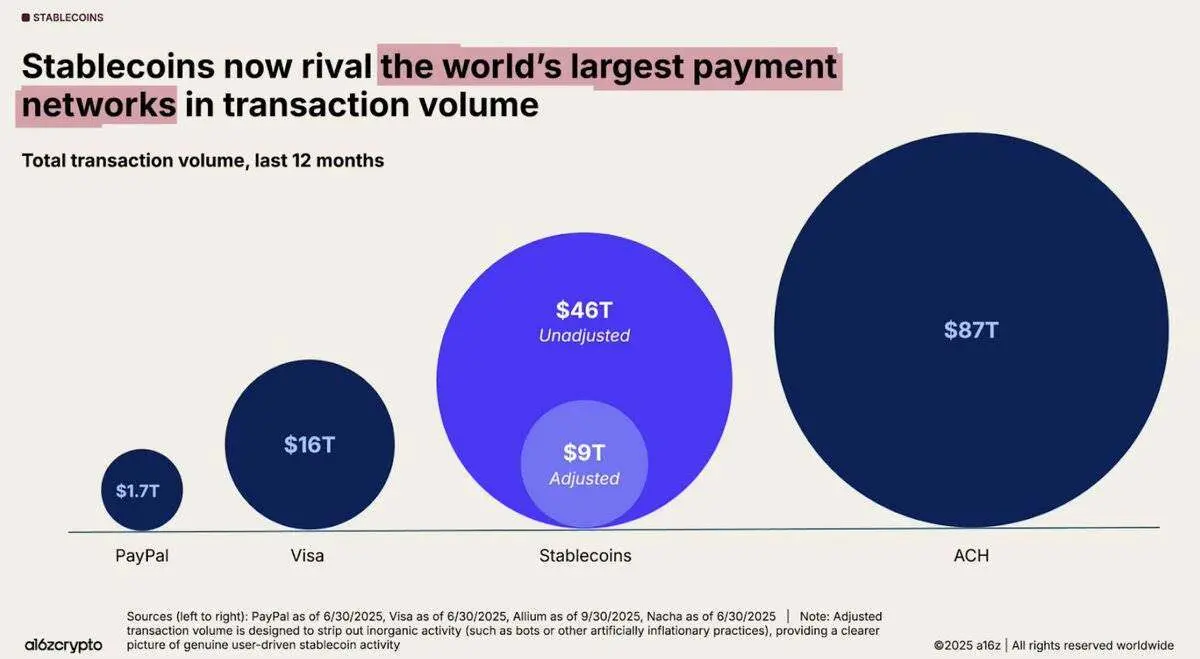

The Stable Currency fulfilled its core commitment: a large programmable dollar. The chain-stabilized currency transactions have reached $46 trillion over the past 12 months, an increase of 106 per cent over the same period and an average of nearly $4 trillion per month。

From cross-border settlement to ETF infrastructure, and then to DeFi liquidity, these tokens become financial hubs in the encryption field, making the block chain a truly functional dollar network. However, the success of the stabilization currency is accompanied by the emergence of systemic vulnerabilities。

The year 2025 exposed the risk of revenue-type and algorithm stabilization currencies, especially those supported by domestic leverage. The XUSD collapse of Stread Finance to US$ 0.18 resulted in the evaporation of US$ 93 million from users and left $285 million in agreement-level debt。

Elixir's deUSD collapsed because of a large loan default. USDx on AVAX fell on suspicion of manipulation. These cases, without exception, reveal how non-transparent collateral, rehypothecation and concentration of risk led to the loss of a stable currency。

This vulnerability was further amplified by the boom in 2025. The influx of capital into the revenue-based stable currency, some of which provides annualized rates of return of up to 20 to 60 per cent through complex treasury strategies. @ethena_labs, @sarkdotfi and @pendle_fi have absorbed billions of dollars and traders are pursuing structural gains based on synthetic dollars. However, with the collapse of deUSD, XUSD and so on, it turns out that DeFi is not really mature, but rather concentrated. Nearly half of the total stock in the ITAL is concentrated in @aave and @LidoFinance, while other funds are concentrated in a small number of strategies related to the revenue-based stabilization currency (YBS). This leads to a fragile ecosystem based on over-leveraging, regressive financial flows and shallow diversification。

As a result, while the stabilization currency provides the system with momentum, it also increases the pressure on the system. We are not saying that the stabilizer is already & ldquo; bankruptcy & rdquo; they are vital to the industry. However, 2025 proved that the design of the stabilization currency was as important as its functionality. As we enter 2026, the integrity of dollar-denominated assets has become a primary concern, not only for the DeFi agreement, but also for all participants in the distribution of capital or the construction of the financial infrastructure along the chain。

4. L2 INTEGRATION AND CHAIN COLLAPSE

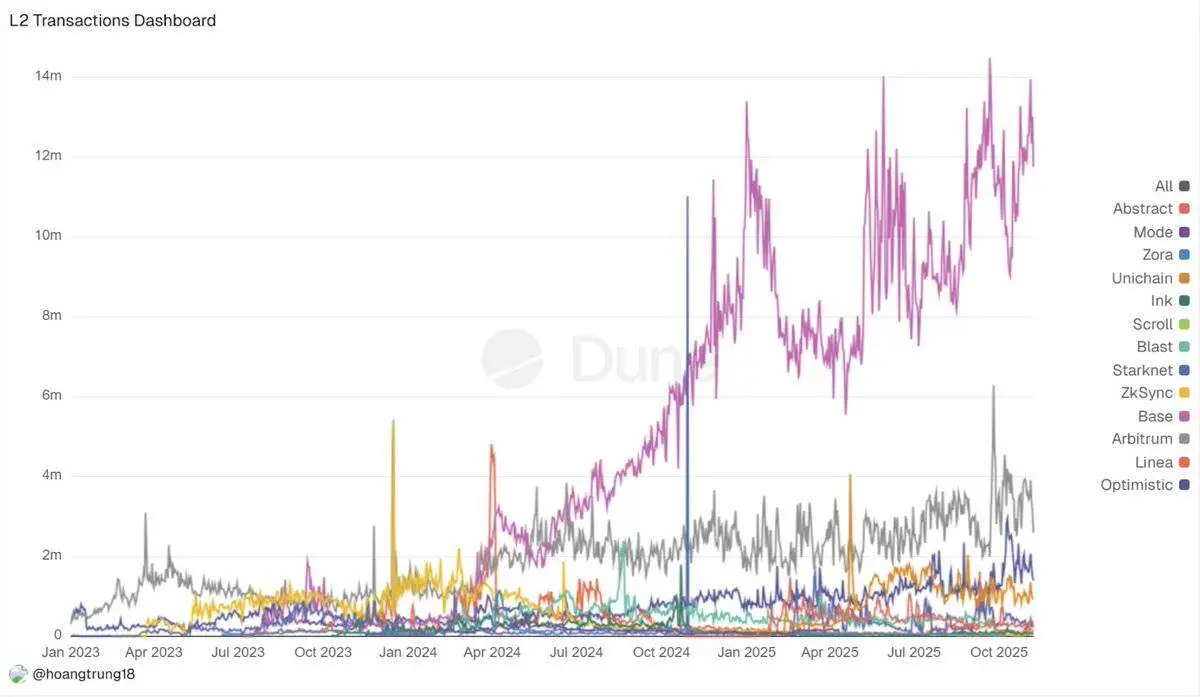

In 2025, the Tai Po & ldquo; the Rollup centre & rdquo; the road map collided with market realities. There have been dozens of L2-Beat projects, which have now evolved into &ldquao; winner-takes-all &rdquao; situation: @arbitrum, @base and @Optimism attracted most of the additional locking volumes (TVL) and financial flows, while the smaller Rollup project has reduced its income and activity by between 70 and 90 per cent after the incentives have ended. Liquidity, MEV robots and arbitragers follow deep and tight price differentials, reinforcing this flyer effect and drying up the order flow of the marginal chain。

At the same time, the proliferation of cross-chain bridge transactions, amounting to $56.1 billion in July 2025 alone, clearly indicates that &ldquao; all of this is Rollup&rdquao; it still actually means &ldquao; everything is fragmentation &rdquao; Users continue to need to cope with isolated balances, L2 original assets and duplicate liquidity。

It needs to be clear that this is not a failure, but a process of integration. Fusaka achieved 5 & ndash; eight times the Blob throughput, with a zk application chain like @Lighter_xyz reaching 24,000 TPS, as well as some of the emerging solutions (e.g. Aztec/Ten providing privacy, MegaETH providing super high performance), all indicating that a few implementation environments are emerging。

others entered “ hibernation mode ” until they proved that their moats were deep enough that the leaders could not simply replicate their advantages through forks。

5. Predicting market rise: from marginal instruments to financial infrastructure

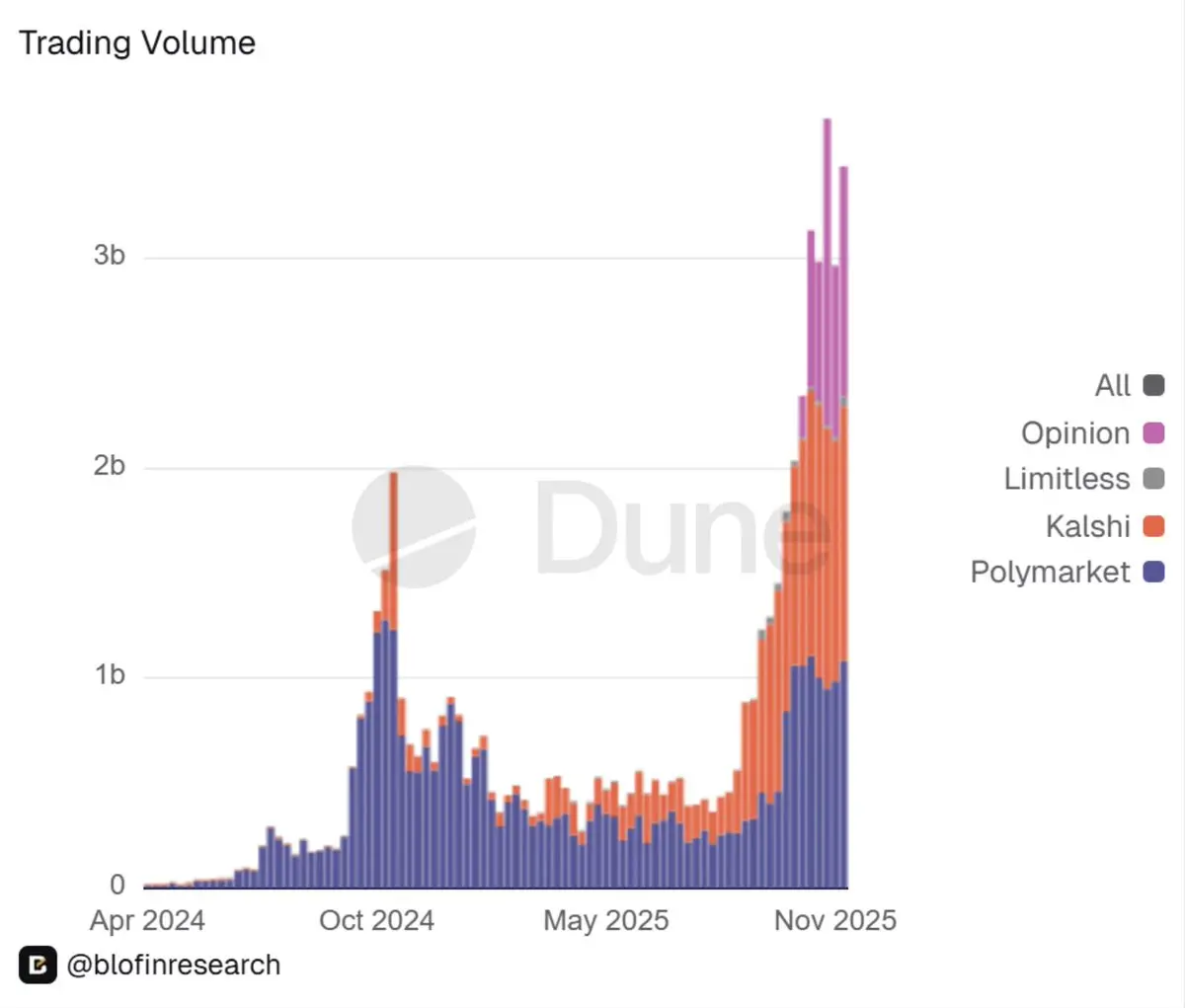

Another big surprise in 2025 was the prediction of formal legalization of markets。

Once seen as a peculiar feature of marginalization, it is now predicted that the market is gradually being integrated into the financial infrastructure. Long-standing industry runner & nbsp; @Polymarket, in a regulated form, re-enters the United States market: its United States branch was approved by the United States Commodity Futures Trading Commission (CFTC) to become the designated contracting market (Designated Contract Market). In addition, it was reported that the Intercontinental Exchange (ICE) invested billions of dollars in capital, valued at close to $10 billion. The financial flows followed。

The forecast market is from &ldquao; interesting small markets &rdquao; leaping to billions of dollars a week, with @Kalshi platform alone handling tens of billions of event contracts in 2025。

i think this marks a transformation of the market on the block chain from “ toy ” to real financial infrastructure。

Mainstream sports gaming platforms, hedge funds and managers born of DeFi now see Polymarket and Kalshi as predictive tools rather than entertainment products. The encryption project and DAO have also started to view these order books as sources of real-time governance and risk signals。

However, this DeFi & ldquo; weaponization & rdquo; also has two sides. Regulatory reviews will be more rigorous and liquidity will remain highly focused on specific events and &ldquao; predicting markets as a signal &rdquao; and correlation with real-world results is not yet proven in stress situations。

looking ahead to 2026, we can make it clear that the event market has now entered the institutional sphere of concern, along with the right to a permanent contract. the portfolio will need to have a clear view of whether and how — — and the configuration of such exposures。

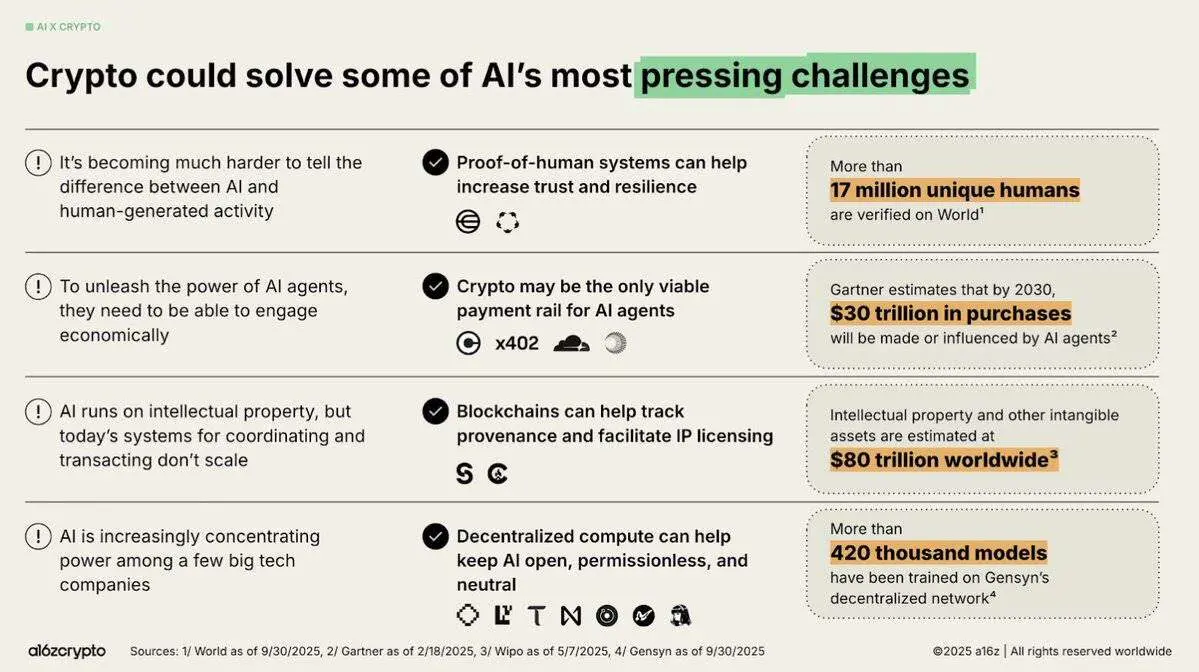

6. INTEGRATION OF AI AND ENCRYPTION: FROM HOT CONCEPTS TO PHYSICAL INFRASTRUCTURE CHANGES

IN 2025, THE COMBINATION OF AI AND ENCRYPTION MOVED FROM LOUD NARRATIVES TO STRUCTURED PRACTICAL APPLICATIONS。

I believe that there are three themes that define the development of the year:

First, the proxy economy has moved from a speculative concept to an operational reality. An agreement such as x402 enables AI agents to trade autonomously in stable currency. The formation of the USDC integration of Circle, as well as the emergence of structured frameworks, credit layers and verifiable systems (e.g. EigenAI and Virtuals), highlights the need for useful AI agents to collaborate, not just to reason。

Second, the decentralised AI infrastructure became the core pillar in this area. The dynamics of Bittensor’s upgrading TAO and the December events of halving it were redefined as “ bitcoin &rdquo in the AI world; the NEAR chain abstraction (Chain Action) led to actual transaction volumes of intent; and @rendernetwork, ICP and @SentientAGI validated the feasibility of decentrization calculations, model tracers and hybrid AI networks. It is clear that the infrastructure received a premium, while “ AI Packaging ” the value is declining。

Thirdly, the operational vertical integration accelerates the advance。

@almanak the AI group deployed a quantitative DeFi strategy, @virtuals_io generated $2.6 million in cost revenue on Base and robotics, predictive markets and geospatial networks became a credible proxy environment。

The shift from “ AI package ” to verifiable agent and robot integration indicates that the match with the market is growing. However, trust infrastructure remains a critical missing link, and the risk of hallucination remains a cloud at the top of autonomous trading。

OVERALL, MARKET SENTIMENT AT THE END OF 2025 WAS OPTIMISTIC ABOUT INFRASTRUCTURE, CAUTIOUS ABOUT THE UTILITY OF AGENTS, AND IT WAS WIDELY FELT THAT 2026 COULD BE A BREAKTHROUGH YEAR ON A PROVEN AND ECONOMICALLY VALUABLE CHAIN。

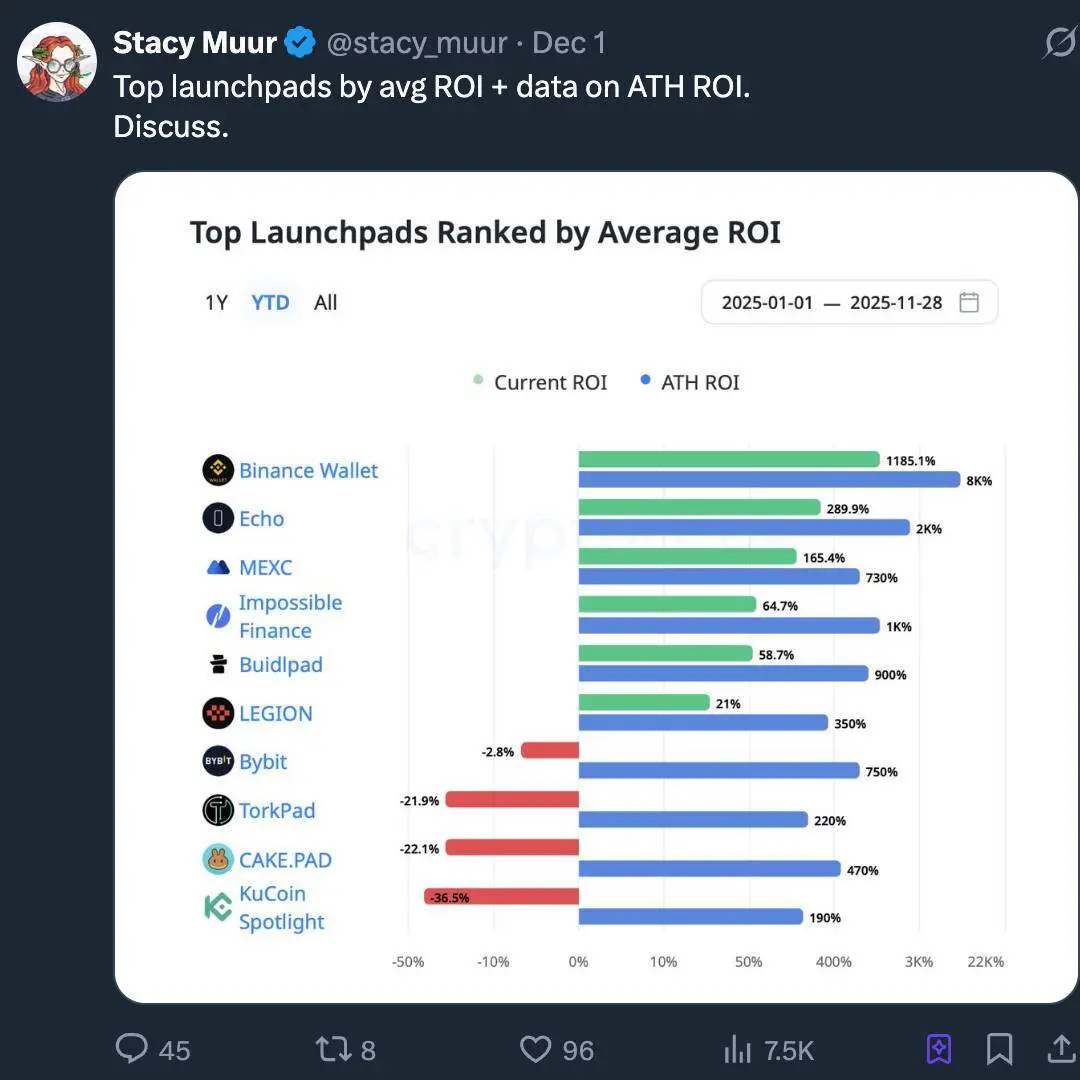

Launching the Platform Return: A New Era of Retail Capital

We believe that the launch of the platform in 2025 was not the “ the return of ICO; but the industrialization of ICO. The market's so-called “ ICO 2.0 & rdquo; in fact, the maturity of encrypted capital formation stacks has evolved into Internet Capital Markets, ICM: a programmable, regulated, day-to-day marketing track rather than just “ lottery & rdquo; token sales。

As a result of the withdrawal of SAB 121, regulatory clarity has been accelerated by transforming tokens into financial instruments with attribution periods, information disclosure and recourse rights, not just simple issues. A platform such as Aligerz embeds equity into the institutional layer: the Hashishization bid, the refund window, a token attribution schedule based on lockout deadlines rather than internal channels. “ no VC for sale, no internal gain ” no longer a slogan, but rather a structural choice。

At the same time, we note that the launching of the platform is integrating into the exchange, which is a sign of a structural shift: the relevant platforms of Coinbase, Binance, OKX and Kraken provide compliance with KYC/AML (know your customer/anti-money laundering), liquidity security, and well-planned distribution channels accessible to institutions. Independent start-up platforms are forced to concentrate on vertical areas (e.g. games, memes and early infrastructure)。

At the narrative level, AI, RWA (real-world asset) and DePIN (decentrochemical networking) occupy the main distribution routes, and activate platforms more like narrative routers than machines. The true story is that the encryption sector is secretly building an ICM layer that supports corporate-level distribution and long-term convergence of interests, rather than repeating the tradition of 2017。

8. NON-INVESTMENT IN HIGH-FDV PROJECTS IS STRUCTURAL

For most of 2025, we have witnessed a repetition of a simple rule: high FDV (total diluted valuation, Full Diluted Participation), low-volume projects are structurally non-investmentable。

Many projects — — especially the new L1 (first layer block chain), the side chain and “ real gains ” tokens — — and market access with more than $1 billion in FDV and single digits。

As one research institute has said, &ldquao; high FDV, low circulation, is a mobile time bomb &rdquao; any early buyer's large-scale sale would destroy the order book directly。

The results are not expected. These tokens went up sharply on the line, but with the advent of the unlocking period and the exit of the insiders, prices fell rapidly. Cobie's motto — — “ refusing to purchase an inflated FDV (total diluting valuation) token ” — — from a web block to a framework for risk assessment. Market traders have increased the price gap and the diaspora has simply ceased to participate, and many such tokens have barely improved in the following year。

By contrast, those tokens that have practical uses, deflation mechanisms or cash flow-linked tokens have been structurally much more than the only selling points are “ high FDV” similar tokens。

I believe that in 2025 the tolerance of the buyer to &ldquao; the economic drama of the coin &rdquao; has been permanently reshaped. FDV and volume are now considered to be rigid, rather than irrelevant notes. In 2026, a project could not actually be invested if its token supply could not be absorbed through an exchange order book without undermining price movements。

9. InfoFi: Rise, fanaticism and collapse

In my view, the prosperity and recession of InfoFi in 2025 became & ldquo; token & rdquo; the clearest cyclical stress test。

InfoFi platforms such as & nbsp; @KaitoAI, @cookiedotfun, @stayloudio commitments to pay analysts, creators and community administrators &ldquao; knowledge work &rdquao; compensation. In a short window of time, the concept became the subject of a hot and risky venture, with significant investment being made by institutions such as Sequoia (Redwood Capital), Pantera (Trust Capital) and Spartan (Sparta Capital)。

The prevailing trend of overloading the encryption industry and the combination of AI and DeFi makes the display of content on the chain look like an obvious missing basic module。

However, this focus as a unit of measure design choice is a double-edged sword: when attention becomes the core measure, content quality collapses. Platforms such as Loud and its kind are flooded by the poor content generated by AI, robotic farms and interactive alliances; a few accounts capture most of the rewards, while long-term users realize that the rules of the game are against them。

The price of multiple tokens went through 80 & ndash; 90 % retreated, and even a complete collapse (for example, when WAGMI Hub raised nine digits of money, it was hit by a major loophole), further undermining the credibility of the field。

The final conclusions show that the first generation of InfoFi (information finance) is structurally unstable. While the core concept — — monetizing valuable encrypted signals — — remains attractive, incentive mechanisms need to be redesigned to base their pricing on the contribution of certification rather than relying solely on the number of hits。

I am confident that by 2026, the next generation of projects will have learned these lessons and will have made improvements。

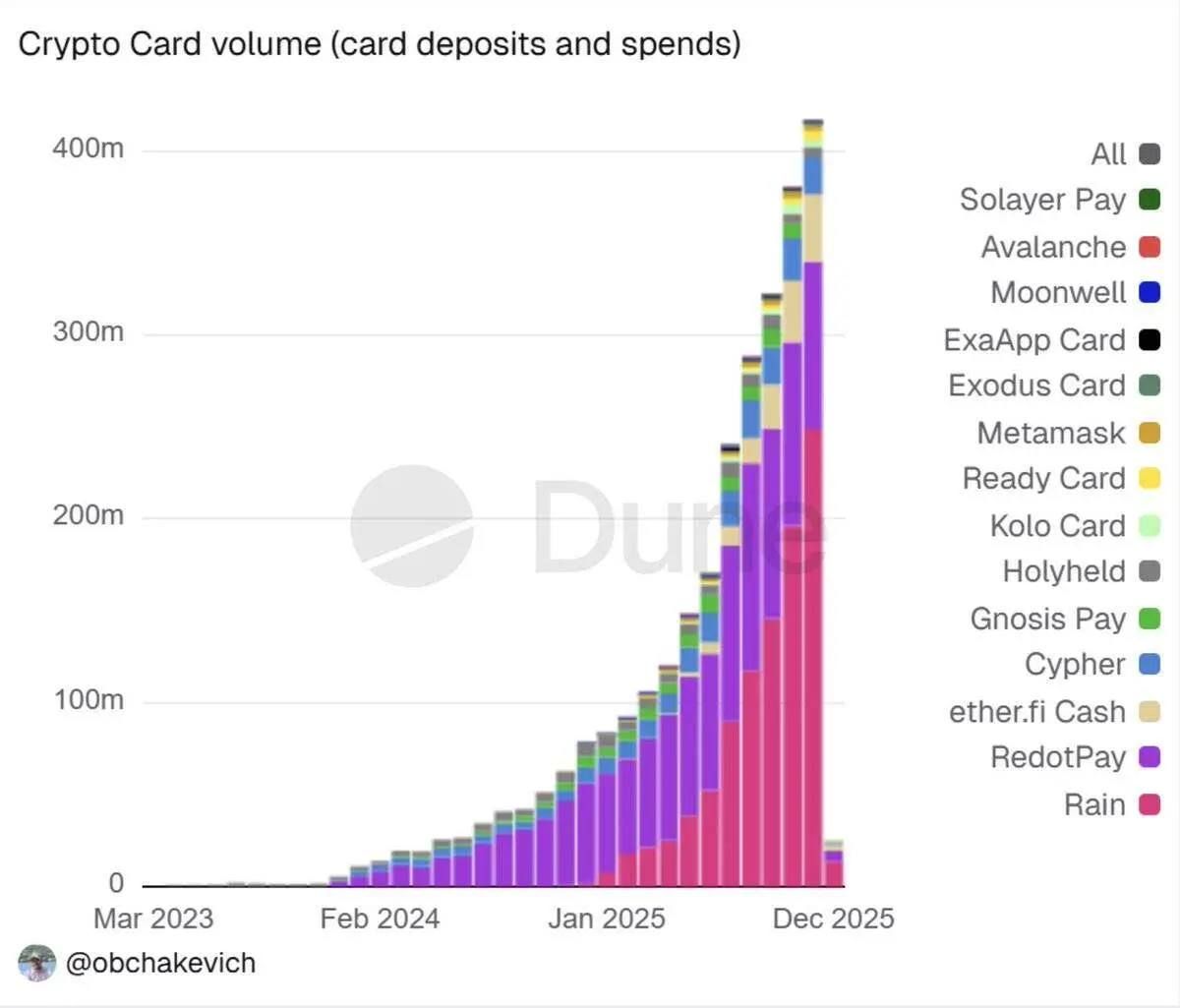

10. The return of consumer encryption: a new paradigm led by new banks

In 2025, the return of consumer encryption was increasingly seen as a structural shift driven by new banking (Neobanks) rather than by local Web2 applications。

In my view, this shift reflects a deeper understanding that when users enter through the financial language that they already know (e.g. deposits, proceeds), the rate of adoption accelerates, while the bottom track of settlements, gains and liquidity moves quietly into the chain。

Ultimately, a hybrid bank stack (Hybrid Banking Stack) was presented, with new types of banks blocking the complexity of Gas fees, hosting and cross-chain bridges, while providing users with direct access to stable currency gains, currencyization of national debt and global payment tracks. As a result, a consumer funnel that attracts millions of users &ldquao; goes deeper along the chain &rdquao; does not need to allow them to think like senior users about complex technical details。

The mainstream view across the industry suggests that new types of banks (Neobanks) are gradually becoming a de facto standard interface for mainstream encryption needs。

Such platforms as @ether_fi, @Plasma, @UR_global, @SolidYield, @raincards and Metamask Card are typical representatives of this shift: they provide instant access to money, 3– 4% return cards, 5&ndash achieved through monetized national debt; 16% annualized return (ASY) and self-hosted smart accounts, all of which are packaged in compliance and supporting the KYC。

THESE APPLICATIONS BENEFITED FROM REGULATORY REPLACEMENTS IN 2025, INCLUDING THE WITHDRAWAL OF SAB 121, THE ESTABLISHMENT OF A STABLE CURRENCY FRAMEWORK AND CLEARER GUIDANCE FOR A MONETIZATION FUND. THESE CHANGES HAVE REDUCED OPERATIONAL FRICTION AND EXPANDED THEIR POTENTIAL MARKET SIZE IN EMERGING ECONOMIES, ESPECIALLY IN AREAS WHERE REAL PAINS ARE HIGH, SUCH AS RATES OF RETURN, FOREIGN EXCHANGE SAVINGS AND REMITTANCES。

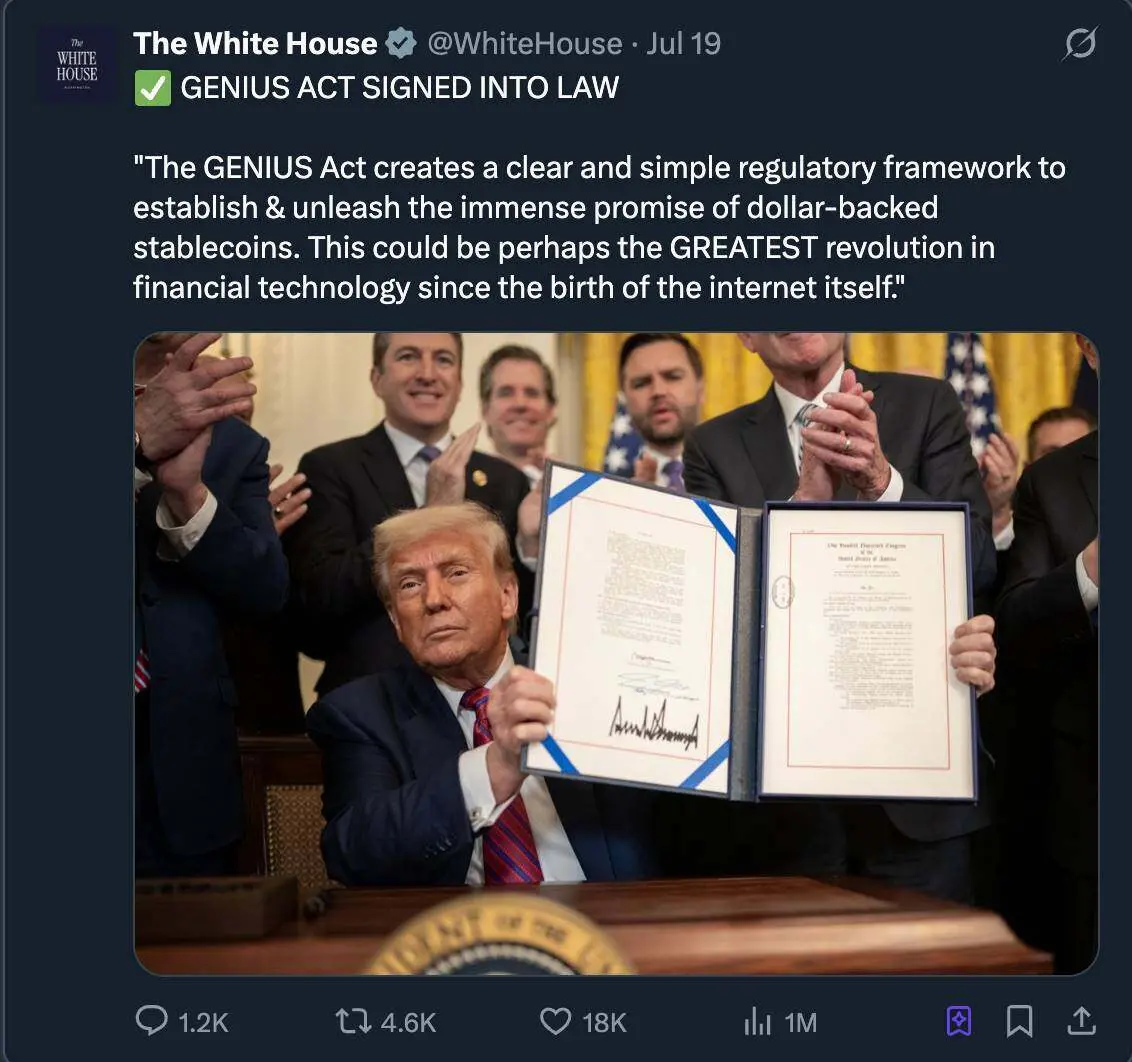

Normalization of global regulation of encryption

I think 2025 is the year in which encryption regulation finally normalizes。

Conflicting regulatory directives have evolved into three identifiable regulatory models:

- European Framework: including the Market Encrypted Assets Act (MiCA) and the Digital Operating Resilience Act (DORA), more than 50 MiCA licences have been issued and the issuer of a stable currency is considered an electronic money agency。

- The US-style framework includes a stabilization currency law similar to GENIUS Act, guidance from SEC/CFTC and the introduction of a spot bitcoin ETF。

- THE ASIA-PACIFIC REGION ' S CODING MODEL: SUCH AS HONG KONG ' S FULL RESERVE STABILIZATION CURRENCY REGULATION, SINGAPORE ' S LICENSE OPTIMIZATION, AND THE WIDER FATF TRAVEL RULES。

This is not superficial, but a complete remodelling of the risk model。

Stabilized currency from “ shadow bank ” converted to regulated cash equivalents; banks such as Citi Bank (Citi) and Bank of America (BoA) can now run a cash-for-currency pilot under clear rules; platforms such as Polymark can be re-entered under the supervision of the Commodity Futures Trading Commission (CFTC); and United States spot bitcoin ETF can attract more than $35 billion in stable inflows without the risk of survival。

Compliance has changed from a drag to a moat: institutions with strong regulatory science and technology (regtech) structures, clear equity tables (cap table) and auditable reserves can suddenly enjoy lower capital costs and faster institutional access。

in 2025, encrypted assets changed from grey area curiosity to a regulated target. looking ahead to 2026, the focus of the debate has been from “ whether the industry is allowed to exist ” to “ how to implement specific structures, disclosure and risk control &rdquo。